In January 2023, federal authorities announced the results of a sweeping investigation known as Operation Nightingale. More than 7,600 fraudulent nursing diplomas and transcripts had been sold by accredited but corrupt Florida nursing schools.

Individuals used these documents to sit for national nursing board exams, obtain licensure in multiple states, and secure employment as registered nurses and licensed practical or vocational nurses.

Healthcare employers faced an immediate operational and compliance problem with consequences that extended well beyond the initial headlines.

What Happened in Operation Nightingale

Between approximately 2016 and 2021, operators at several Florida-based nursing schools sold fake diplomas and transcripts for about $15,000 ... Read More

Press Releases and News

17

Feb2026

In healthcare and healthcare staffing, everyone is chasing the same outcome: get qualified clinicians in place quickly, safely, and compliantly. The race to fill open roles has never felt more urgent, and the pressure on margins has never been heavier.

Somewhere inside that race, there's a friction point that rarely makes it onto a dashboard but quietly costs real money. It slows time-to-fill, frustrates clinicians before they ever step on site, and chips away at drop-off rates that most organizations can't fully explain.

That friction point is the background screening experience.

At Universal Background Screening, one of the most consistent things we've heard ... Read More

February 17, 2026Ashley McManus

14

Feb2026

Healthcare workforce compliance used to be something you checked off at hire. Now, it is a daily responsibility. Every practitioner, clinician, and technician in your organization needs an active, valid license to practice–not just on their first day, but every day after. When a lapsed credential slips through, the consequences are immediate: regulatory penalties, accreditation risks, payer clawbacks, and patient safety concerns.

Most healthcare organizations are still running compliance systems that weren't built for this continuous reality.

The Problem with Traditional Verifications

Traditional primary source verifications take time and are often siloed. They usually require 3 to 5 contact attempts over 5 to ... Read More

February 14, 2026Ashley McManus

10

Feb2026

You've probably heard vendors promise "instant background checks." In our last article, we covered why that's not realistic for regulated hiring. This time, let's talk about what actually makes enterprise clients stay with a screening provider year after year.

It's not turnaround time alone.

The Easy Metrics Don't Tell the Whole Story

Turnaround time, cost per report, volume capacity: these are easy to measure and easy to compare on a spreadsheet. They matter when you're hiring at scale.

What keeps enterprise teams satisfied over the long term is reliability.

Consistency Across Thousands of Searches

Enterprise hiring teams run hundreds or thousands of background checks across different ... Read More

February 10, 2026Ashley McManus

05

Feb2026

When you run a background check, you might assume all criminal records are just a few clicks away online. The reality is more complicated. Many U.S. courts don't maintain searchable online databases, which means accessing certain criminal records requires a different approach: working directly with court staff to retrieve the information you need.

This process is called a clerk assisted criminal search, and it's an important part of thorough background screening. Here's what employers should know about how these searches work and why they matter.

How Clerk Assisted Searches Work

A clerk assisted search means your background screening provider contacts courthouse personnel to ... Read More

February 5, 2026Ashley McManus

03

Feb2026

You've probably heard vendors promise "instant background checks." Maybe you've even wondered why your own screening process takes longer than advertised.

Truly instant background checks don't exist in regulated enterprise hiring. Not because of technology limitations, but because of how courts and public records actually work.

Let's talk about why.

The Database Shortcut (and Why It's Usually Not Enough)

Some providers lean heavily on database searches because they're fast. You query a pre-aggregated system, you get results in seconds. On paper, it looks instant.

Database results come with gaps, though. Records can be incomplete. Dates get outdated. Dispositions go missing entirely. Coverage varies wildly depending ... Read More

February 3, 2026Ashley McManus

28

Jan2026

Ever wonder what happens after you submit a candidate's information for a criminal background check? The process is more nuanced than most employers realize, and understanding it can help you make better hiring decisions while staying compliant.

Here's what actually happens when you run a criminal record search.

There's No Magic Database (And Why That Matters)

Despite what some screening companies might suggest, there's no single "national criminal database" that captures every arrest and conviction across the country. Instead, criminal records live at the county, state, and federal levels, and each jurisdiction maintains its own system.

This is why jurisdiction-based searches are critical. When ... Read More

January 28, 2026Ashley McManus

27

Jan2026

In a prior article, we covered the basics: how background checks work, what to expect, and typical timelines. This article picks up where that one left off.

Here, we're talking about what happens when something goes wrong. When information doesn't match. When you need to dispute an error. When identity theft is involved. We'll also cover what employers need to know about managing these situations.

Your Rights During a Background Check

What rights do candidates actually have?

The Fair Credit Reporting Act (FCRA) protects you when a background check is used for employment. You have the right to know a check is being run, ... Read More

January 27, 2026Ashley McManus

21

Jan2026

The Joint Commission’s decision to eliminate more than 700 redundant accreditation standards is one of the most meaningful compliance updates healthcare organizations have seen in years.

While the headline number is attention-grabbing, the deeper implication matters more. This shift reflects a broader recalibration of how healthcare compliance should function in a modern, high-risk, high-pressure environment. For hospital HR leaders, compliance teams, and credentialing professionals, it reinforces an important truth. Effective compliance is not about volume. It is about clarity, accountability, and real-world impact.

A Clear Move Toward Smarter Compliance

The Joint Commission’s Accreditation 360 overhaul focused on identifying standards that were duplicative, overlapping in intent, or creating ... Read More

January 21, 2026Ashley McManus

13

Jan2026

If you've recently reviewed a criminal background screening report and noticed a candidate's date of birth was missing or redacted, you're not alone. This is becoming more common across the country, and it often raises questions for HR teams and hiring managers who want to ensure they're making informed, defensible hiring decisions.

Here's what's happening and why your background check is still complete.

The Shift in How Courts Handle Personally Identifiable Information

Courts nationwide are rethinking how they manage public access to sensitive data. While transparency in public records has always been important, there's been a growing recognition that certain personally identifiable information ... Read More

January 13, 2026Ashley McManus

12

Jan2026

The compliance landscape for workplace drug testing is shifting faster than many employers realize. Between federal cannabis rescheduling discussions, proposed DOT panel expansions, and state-by-state cannabis law changes, HR teams and safety managers are facing a critical question: is our drug testing program actually ready for what's coming?

At Universal Background Screening, our Drug Testing & Occupational Health (DTOH) team works with employers every day who are navigating these exact challenges. Understanding what these changes actually mean for your workforce, your liability, and your day-to-day operations requires more than tracking headlines.

Here's what you need to know right now.

Federal Marijuana Rescheduling: Separating ... Read More

January 12, 2026Ashley McManus

06

Jan2026

Background checks are part of nearly every hiring process today, but that doesn't mean they're always straightforward. Whether you're a candidate wondering what's taking so long or an employer setting up screening for the first time, we get it; you have questions.

We've compiled the most common ones here, with answers that actually help.

General Information

What does Universal Background Screening do?

We help companies make informed hiring decisions through employment background checks and workforce screening. That includes criminal history searches, drug testing, employment and education verification, motor vehicle records, occupational health services, and compliance support.

Think of us as the bridge between candidates, employers, ... Read More

January 6, 2026Ashley McManus

15

Dec2025

Universal Background Screening (UBS), a national leader in compliant, high-quality background screening services, has appointed Susan Horn as Senior Vice President of Sales. Horn brings extensive experience leading high-performing sales teams across the background screening and healthcare industries, with a strong focus on service excellence and long-term client success.

“This is an exciting time at UBS. The passion for our customers, our service and our culture is second to none. I’m excited to tap into the collective abilities of the sales team to grow and strengthen our position in the market,” said Susan Horn, Senior Vice President of Sales at Universal ... Read More

December 15, 2025Ashley McManus

11

Dec2025

Universal Background Screening (UBS), a leader in compliant, high-quality background screening services for employers nationwide, has appointed Claire Martin as Chief Financial Officer (CFO). With more than two decades of global finance leadership across high-growth SaaS, e-commerce, and technology companies in the United States and Europe, Martin brings the financial acumen and strategic vision UBS will leverage as the company scales operations and strengthens its market position.

“UBS’s momentum and commitment to building a world-class background screening organization truly resonated with me. I’m eager to support the company’s growth, innovation, and long-term vision,” said Claire Martin, incoming CFO of Universal Background ... Read More

December 11, 2025Ashley McManus

10

Dec2025

Universal Background Screening (UBS), a trusted provider of background screening and compliance solutions for regulated industries, has announced the appointment of Val Poltorak as President today. Poltorak brings more than twenty years of leadership experience across SaaS, FinTech, healthcare, staffing, and other compliance-focused sectors. Her background includes building high-performing teams, improving operations, and supporting organizations through strong, client-centered growth.

"I have spent my career putting customers first," said Poltorak. "I am excited to join UBS at a pivotal time for the industry, helping drive growth and deliver exceptional client experiences in background screening."

Before joining UBS, Poltorak held senior leadership roles at ... Read More

December 10, 2025Ashley McManus

09

Dec2025

Smart Tags are one of the most valuable tools UBS offers to help clients manage hiring decisions with greater accuracy, speed, and consistency. As adoption grows, we've seen a need to better explain how Smart Tags work, how they're implemented, and how clients use them day to day.

This article provides a clear, updated overview based on the latest Smart Tags Product Guide, Q&A, and Sales and Implementation documentation. It's designed to help our clients understand the full lifecycle of Smart Tags, from initial setup through operational use.

What Smart Tags Do

Smart Tags automate the first level of background report review by ... Read More

December 9, 2025Ashley McManus

08

Dec2025

Background screening isn't just about checking boxes or rushing through reports. It's about building trust through diligence, openness, and an unwavering commitment to do right by both clients and their candidates. At UBS, we take pride in setting ourselves apart, and that difference shows in our approach to verification, response, and industry leadership.

Going Direct: The Power of Primary Source Verification

Many background screening providers rely on aggregated databases, pulling in large stores of historical data without adequately checking for accuracy or currency. The result? Outdated or incorrect information, exposing clients to risk and candidates to unfair roadblocks.

UBS does more than merely ... Read More

December 8, 2025Ashley McManus

02

Dec2025

Strong compliance processes are essential in healthcare staffing, where even a small oversight can affect patient care and partner trust. For Mandy Sudbeck, Director of Compliance at Atlas MedStaff, choosing the right background screening partner is critical to keeping clinicians moving through the hiring process quickly and accurately.

Mandy began her career in property management before moving into healthcare credentialing. From day one, she learned how important reliable screening is for protecting patients and meeting hospital requirements. When she joined Atlas MedStaff, she brought her familiarity with Universal Background Screening (UBS) with her.

“I saw firsthand how Universal operates and the quality ... Read More

December 2, 2025Ashley McManus

20

Nov2025

At Universal Background Screening, we know that hiring teams today need more than a vendor. They need a partner that continuously improves, anticipates compliance changes, and builds tools that make screening smoother for both employers and candidates. That's why our product and engineering teams deliver enhancements designed to reduce friction, strengthen compliance, and streamline workflows across the platforms your teams already use.

Below is a summary of the latest updates across Background Screening, ATS Integrations, and UHealth services. All of these features are available now or rolling out shortly for UBS clients:

Enhanced ATS Integrations for Faster Hiring

Bullhorn: eForms Ordering Now Available

For ... Read More

November 20, 2025Ashley McManus

19

Nov2025

Hiring decisions carry significant weight. Organizations need background screening partners who maintain rigorous standards and bring genuine transparency to every engagement. At Universal Background Screening (UBS), these principles guide everything we do.

Primary Source Verification: The Accuracy Standard

Many background screening providers rely primarily on aggregated databases. While this approach offers speed, it can introduce risk. Data may be incomplete, outdated, or inaccurate. Some firms stop at summary-level information. UBS takes a different approach.

When we detect potentially adverse information in a background check, we take an additional step: we verify the information at its primary source. We confirm whether the information remains ... Read More

November 19, 2025Ashley McManus

17

Nov2025

The Work Opportunity Tax Credit (WOTC) represents one of today's most significant, yet consistently underutilized, employer incentive programs. With credits reaching $9,600 per eligible hire, this federal initiative offers substantial cost recovery opportunities that thousands of businesses forfeit annually due to administrative complexity, regulatory requirements, and process gaps.

Universal Background Screening (UBS) has established a strategic partnership with VerifyToday to address these challenges, delivering a comprehensive solution that transforms WOTC tax credit optimization from an administrative burden into a streamlined savings opportunity.

The WOTC Implementation Gap

Three primary factors prevent organizations from maximizing WOTC benefits:

Knowledge barriers exist across many HR departments, where teams remain unaware that ... Read More

November 17, 2025Ashley McManus

13

Nov2025

If you've ever had to delay a critical hire because fingerprinting took weeks instead of days, you already know the problem. In regulated industries like healthcare, education, and financial services, fingerprint-based background checks aren't optional. They're the law. Yet somehow, in 2025, most organizations are still managing this process like it's 1995.

Manual scheduling. Paper trails. Scattered compliance records. Frustrated candidates who can't figure out where to go or when. And at the end of it all, a hiring timeline that stretches far longer than it should.

The real cost isn't just time. It's lost talent, compliance risk, and the operational burden ... Read More

November 13, 2025Ashley McManus

12

Nov2025

Background screening has become essential for building trust, staying compliant, and making smart hiring decisions. Organizations need employment background checks that go beyond verifying information. They need screening partners who help protect their reputation, maintain safe workplaces, and navigate an increasingly complex regulatory environment. For over 50 years, that's what UBS has been doing.

A Legacy of Client-Centric Service

UBS didn't build its reputation by simply processing checks and moving on. We've always taken a different approach: partnering with clients as consultants and educators. We help organizations understand the complex landscape, apply best practices, and build screening programs that actually work for ... Read More

November 12, 2025Ashley McManus

10

Nov2025

How One Screening Mistake Can Derail Your Entire Hiring Process

We've all been there: You've found the perfect candidate. They aced the interviews, their references checked out, and your team is excited to bring them on board. Then the background check comes back with something unexpected.

Maybe it's a criminal record that's actually been expunged. Perhaps it's an educational credential that was verified incorrectly. Or it's outdated information that shouldn't even be reportable anymore. Now you're stuck in limbo: Do you move forward and risk compliance issues? Do you restart the screening process and lose weeks? Do you let a great candidate ... Read More

November 10, 2025Ashley McManus

07

Nov2025

Hiring new employees represents one of the largest line items in any business budget. Yet many organizations overlook a significant opportunity to offset these costs through federal tax savings that can reach up to $9,600 per eligible hire.

The Work Opportunity Tax Credit (WOTC) remains one of the most underutilized employer incentive programs available today. While some businesses question whether the administrative effort justifies the return, the financial impact speaks for itself.

Assessing Your Savings Potential

Consider these strategic questions when evaluating WOTC's relevance to your organization:

Does your company hire 20 or more employees annually? Organizations with regular hiring activity typically see ... Read More

November 7, 2025Ashley McManus

05

Nov2025

Healthcare hiring has become a compliance minefield. Between Joint Commission standards, state licensing boards, CMS Conditions of Participation, and FCRA requirements, healthcare HR teams are managing more regulatory touchpoints than ever before.

The traditional approach? Cobble together multiple vendors. One handles criminal background checks. Another manages drug screening. A third verifies professional licenses. Someone else handles employment and education verification. Then there's I-9 management, fingerprinting for state databases, and ongoing credential monitoring.

This fragmented model made sense when each screening component was highly specialized. But the healthcare workforce has changed. Travel nurses, locum tenens physicians, and contract staff move between facilities constantly. ... Read More

November 5, 2025Ashley McManus

30

Oct2025

The Work Opportunity Tax Credit (WOTC) offers employers significant savings, up to $9,600 per eligible hire. Many companies understand the value of this federal tax incentive. Where they run into trouble is managing the timing requirements that determine whether credits can be claimed.

We work with employers who hire from eligible target groups regularly. They're doing everything right when it comes to building their teams. The challenge comes down to documentation and filing windows. When those get missed, valuable tax credits simply can't be recovered.

Understanding WOTC Timing Requirements

The work opportunity tax credit process has specific checkpoints that employers need to meet:

Screen ... Read More

October 30, 2025Ashley McManus

23

Oct2025

Universal Background Screening (UBS) has partnered with WorkBright, a leading employment compliance platform, to deliver an enhanced I-9 verification solution that helps organizations onboard faster while maintaining full compliance.

Addressing Real I-9 Challenges

For companies hiring at scale, especially in regulated industries, employment eligibility verification can become a significant bottleneck. Manual I-9 processes introduce data entry errors, slow down new hire onboarding, and create audit risks that compliance teams work hard to avoid.

UBS selected WorkBright as its preferred I-9 partner because of their proven track record and technology. WorkBright has processed over 4 million I-9 forms with zero audit fines and maintains ... Read More

October 23, 2025Ashley McManus

21

Oct2025

We've discussed previously how the Work Opportunity Tax Credit (WOTC) represents a significant opportunity, offering up to $9,600 per eligible hire. Yet many organizations leave money on the table. Not because they lack qualifying candidates, but because they overlook critical employment details that determine eligibility.

At Universal Background Screening, we've seen how seemingly minor oversights in employee classification and hour tracking can derail otherwise solid WOTC strategies. The difference between maximizing your tax credits and missing them entirely often comes down to understanding exactly why employment details matter.

The Foundation: Getting Employment Classification Right

W-2 status isn't just an administrative detail, but a ... Read More

October 21, 2025Ashley McManus

20

Oct2025

In industries like healthcare and staffing, the margin for error is razor thin. A single oversight in a background check can result in regulatory fines, reputational damage, or harm to patients, candidates and clients. At Universal Background Screening (UBS), compliance and risk mitigation form the foundation of everything we do.

Why Compliance Keeps Getting Harder

Background screening providers face growing scrutiny across the industry. Several companies have dealt with class-action lawsuits in recent years for errors and misreporting, often caused by inaccurate or outdated data pulled from secondary databases. These errors harm candidates and expose employers to serious legal and reputational risk.

At ... Read More

October 20, 2025Ashley McManus

14

Oct2025

Every dollar counts when you're running a business. Yet many employers are unknowingly leaving substantial federal tax credits on the table that could significantly impact their bottom line while supporting meaningful workforce diversity initiatives.

The Work Opportunity Tax Credit (WOTC) represents one of the most underutilized business incentives available. This federal program rewards companies that hire individuals from targeted groups, including veterans, long-term unemployed workers, and individuals receiving public assistance. With credits worth up to $9,600 per eligible hire, the financial impact can be transformative for businesses of all sizes.

The challenge? Most organizations lack the systematic approach needed to identify qualifying ... Read More

October 14, 2025Ashley McManus

10

Oct2025

The staffing industry has always run on tight margins and high expectations. But lately? The pressure's intensified. You're competing against firms that'll undercut you on price without blinking. Your clients want faster placements but stricter compliance. And candidates? They expect a hiring experience that doesn't feel like they're applying for a mortgage.

If you're feeling the squeeze, you're not alone.

The Real Cost of Competing on Price Alone

Let's talk about the race to the bottom. Every staffing professional knows there's always someone willing to go cheaper on fees; and often, that means cutting corners on pre-employment screening or candidate quality. The problem ... Read More

October 10, 2025Ashley McManus

07

Oct2025

PHOENIX, AZ — October 7, 2025

Universal Background Screening (UBS) has announced a new partnership with VerifyToday, expanding its suite of employer solutions to include the Work Opportunity Tax Credit (WOTC) program — a federal incentive designed to reward businesses for hiring individuals from targeted groups that face barriers to employment.

For many organizations, the WOTC program represents a significant yet often overlooked opportunity: employers can receive up to $9,600 per eligible hire, but complex compliance requirements and short filing windows often make it difficult to capture those savings.

Through this partnership, UBS clients can now access a fully managed WOTC solution that ... Read More

October 7, 2025Ashley McManus

06

Oct2025

Background screening gives clients confidence in their hiring decisions by delivering the clearest, most complete picture possible. At UBS, we've built our reputation on going deeper than standard searches, combining cutting-edge technology with investigative curiosity and the speed today's hiring timelines demand.

Why We Do This Work

At its core, background screening helps people land the right role. Every search we conduct provides clarity and facts. The goal: give clients the information they need to make confident decisions, fast.

The UBS Difference

UBS explores peripheral jurisdictions because revealing records show up in unexpected places. A candidate might have traveled somewhere for work, spent time ... Read More

October 6, 2025Ashley McManus

03

Oct2025

Customer success at UBS shapes every interaction, every product, and every outcome we deliver. The foundation of our approach comes from understanding what it's like to be on the customer side, managing vendors and experiencing firsthand the frustrations and needs that organizations face when selecting and working with background screening partners.

Building on Real Customer Experience

UBS prioritizes proactive communication, reliability, and building trust by anticipating problems before they impact your business. This commitment stems from a deep understanding of what clients actually need and the challenges they navigate daily in their hiring and compliance processes.

The UBS Partnership Philosophy

UBS is committed to ... Read More

October 3, 2025Ashley McManus

22

Sep2025

At Universal Background Screening (UBS), excellence in workplace drug testing services and compliance isn't the work of a single individual. It's the combined strength of an experienced, innovative, and client-focused Drug Testing and Occupational Health (DTOH) team. Together, these professionals are raising the bar for workplace safety, regulatory compliance, and employee well-being, setting UBS apart in a competitive industry.

A Team Built on Experience and Innovation

The UBS DTOH team brings together over a century of collective senior leadership experience in drug and alcohol testing program management. Their expertise spans the full spectrum of workplace compliance, from policy development and employee education ... Read More

September 22, 2025Ashley McManus

19

Sep2025

Compliance isn't the fun part of hiring. Between industry best practices, federal regulations, and state-specific requirements that seem to change overnight, keeping up can feel like a full-time job on top of your actual full-time job.

We get it. At Universal Background Screening, we've seen HR teams juggling spreadsheets in the eleventh hour, trying to figure out if their screening process will pass their upcoming audit. We've talked to hiring managers who've had great candidates slip away because their background checks took too long to complete. And we've worked with companies scrambling to fix long-standing compliance gaps they just discovered they ... Read More

September 19, 2025Ashley McManus

16

Sep2025

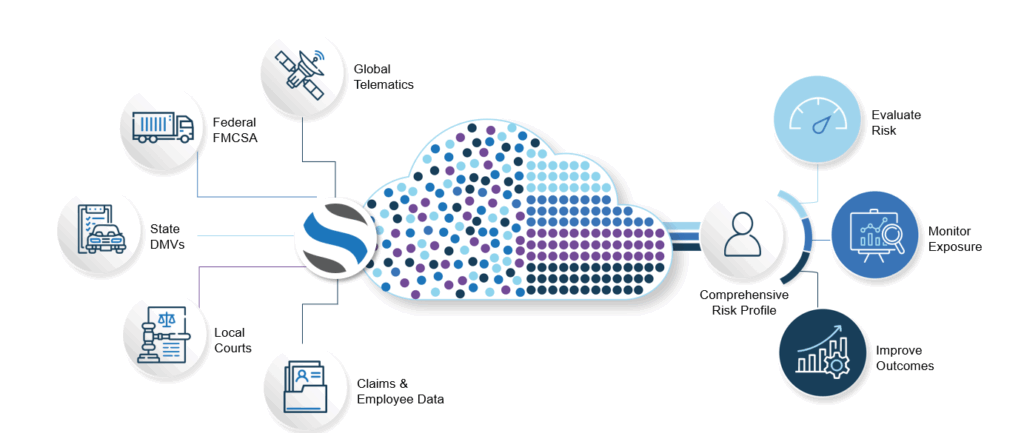

At Universal Background Screening (UBS), we know our customers depend on us not only to deliver accurate background checks, but also to help them stay ahead in an environment where compliance, safety, and risk management grow more complex every day. We're thrilled to share details about our expanding partnership with SambaSafety.

Together, UBS and SambaSafety are shaping a smarter approach to risk management. By combining the expertise of two trusted leaders, we're giving our customers access to new tools and insights that make it easier to protect people, strengthen compliance, and create safer workplaces.

Why the Partnership Matters

Employers today can't afford blind ... Read More

September 16, 2025Ashley McManus